Module 3 - Unit 3: To Non-Profit or not to Non-Profit?

What is a nonprofit organization?

- Nonprofit organizations play a vital role in addressing important social issues like poverty, health care, and human rights.

- 501(c) organizations, often referred to as nonprofits, are exempt from paying federal income tax under the US Internal Revenue Code.

- You are most likely familiar with 501(c)(3)s that are designed to serve the public rather than generate profits.

This 2 minute video explains more about what that means.

501(c) Organization: What They Are, Types, and Examples:

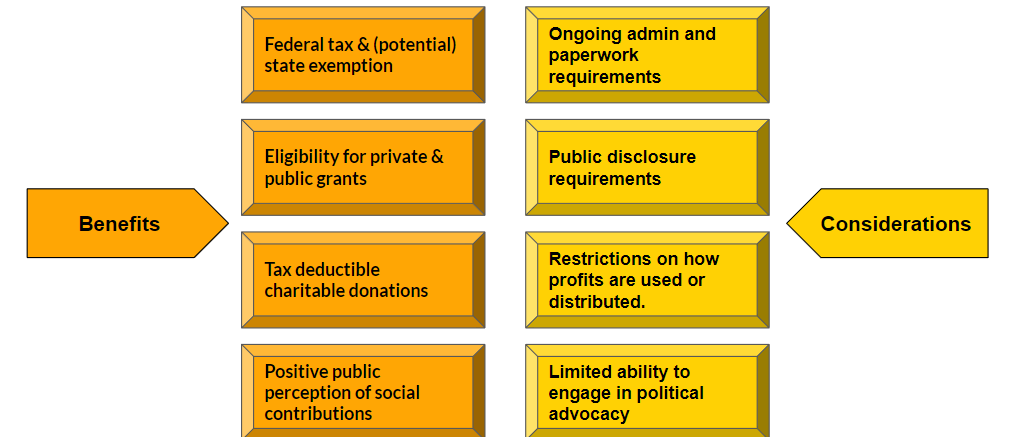

Benefits & Considerations of 501(c)(3) Status

What are the requirements?

A 501(c)3 organization has a dynamic life cycle that requires ongoing attention and effort.

Consider the following examples:

- Active board of directors

- Funds for filing application and filing fees

- Compliance with holding meetings, recordkeeping, and public disclosure

Requirements

- File an application with the IRS

- Pay associated fees, etc. (IRS)

- Keep a detailed record of all activities, both financial and non-financial

- Complete annual filings requirements (e.g., Form 990) (IRS)

- Fulfill public disclosure requirements

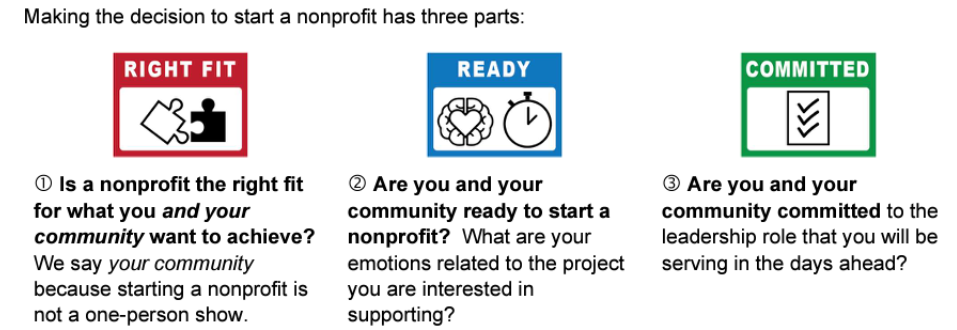

Decisions, Decisions!

Additional Resources

There’s a lot to think about when considering obtaining 501(c)(3) status for your recovery home.

Refer to these resources in the IRS’ Resource Library for more information on 501(c)(3) status.

In addition to becoming a nonprofit, you might also consider status as an LLC, S Corporation, C Corporation, Sole Proprietorship.

And when in doubt, call in the experts!